The Science of Institute Time Clause in Maritime Insurance: A Comprehensive Overview with Case Studies

Marine insurance plays a vital role in safeguarding the interests of shipowners and cargo owners against potential risks and perils associated with maritime transportation. One crucial component of marine insurance is the Institute Time Clause (ITC). The ITC serves as a fundamental provision in marine insurance policies, outlining the scope of coverage and the time-related aspects of the policy. In this post, we would explore Institute Time Clause, its significance, and explore real-world case studies to gain a practical understanding of its application.

Understanding the Institute Time Clause: The Institute Time Clause is a standard provision used in marine insurance policies that defines the duration of coverage. It determines the period during which an insurer is liable for losses and damages to the insured vessel or cargo. The ITC also establishes whether coverage is provided during transit, when the vessel is at rest, or both.

Key Features and Provisions:

Perils Covered: The ITC specifies the perils or risks that are covered under the insurance policy. These may include collisions, fires, piracy, theft, jettison, natural disasters, and other events that can cause damage to the insured vessel or cargo.

Duration of Coverage: The ITC outlines the specific time period during which the coverage is in effect. It differentiates between two main situations: "time on risk" and "time off risk." Time on risk refers to the period when the vessel is underway, exposed to the risks covered by the policy. Time off risk, on the other hand, refers to the period when the vessel is not exposed to the covered risks, typically when it is moored or at anchor.

Suspension and Continuation Clauses: The ITC may include suspension and continuation clauses. Suspension clauses suspend the coverage during specific events, such as war, strikes, or political unrest. Continuation clauses, on the other hand, ensure that coverage continues despite the occurrence of specific events, such as accidents or damage to the vessel, during the voyage.

Warranties and Compliance: The ITC may contain warranties that require the insured party to comply with certain conditions or risk forfeiting the coverage. These conditions may relate to vessel seaworthiness, crew qualifications, adherence to safety regulations, or other factors that affect the risk profile of the insured party.

Case Study 1: Collision at Sea In a case where two vessels collide, causing significant damage, the ITC would come into play. The ITC would determine the coverage for the respective vessels based on the specific provisions and time on/off risk conditions stated in the policy. The insurer would assess the extent of damage and ascertain the liability of each vessel involved, accordingly providing compensation to the affected parties.

Case Study 2: Cargo Theft during Transit Suppose a cargo shipment is stolen while in transit. The ITC would dictate whether the theft is covered under the policy. If the policy includes coverage for theft, the insured party can file a claim based on the provisions outlined in the ITC. The insurer would investigate the incident, assess the loss, and provide compensation as per the terms and conditions of the policy.

The Institute Clauses, also known as the Institute Time Clauses, are insurance clauses that have been developed and approved by the Technical and Clauses Committee of the Institute of London Underwriters. These clauses outline the specific terms and conditions of insurance policies, including the coverage and exclusions related to different types of risks.

The Institute Clauses, sometimes referred to as London Clauses or English Clauses, serve as the foundation for insurance contracts in many countries. The selection of specific clauses for a particular policy depends on factors such as the nature of the insured subject matter and the associated risks.

There are several types of Institute Clauses, including:

Institute Hull Clauses: These clauses were first introduced in 1983 and are used for Hull and Machinery policies. They consist of 26 clauses and were revised in 1995. However, they are currently being replaced by the International Hull Clauses.

International Hull Clauses: Introduced in 2002 after extensive consultation with ship owning associations, insurers, average adjusters, and brokers, these clauses are designed to meet the evolving needs of the global market and legal developments in the UK. They were also updated to comply with the International Safety Management (ISM) Code, which applies to most commercial hulls, including cargo vessels over 500 gross tons (GT). The International Hull Clauses are organised into three sections: Part 1 covers the Principal Insuring Conditions, Part 2 includes additional clauses, and Part 3 outlines claims handling procedures and the responsibilities of the insured and the insurer.

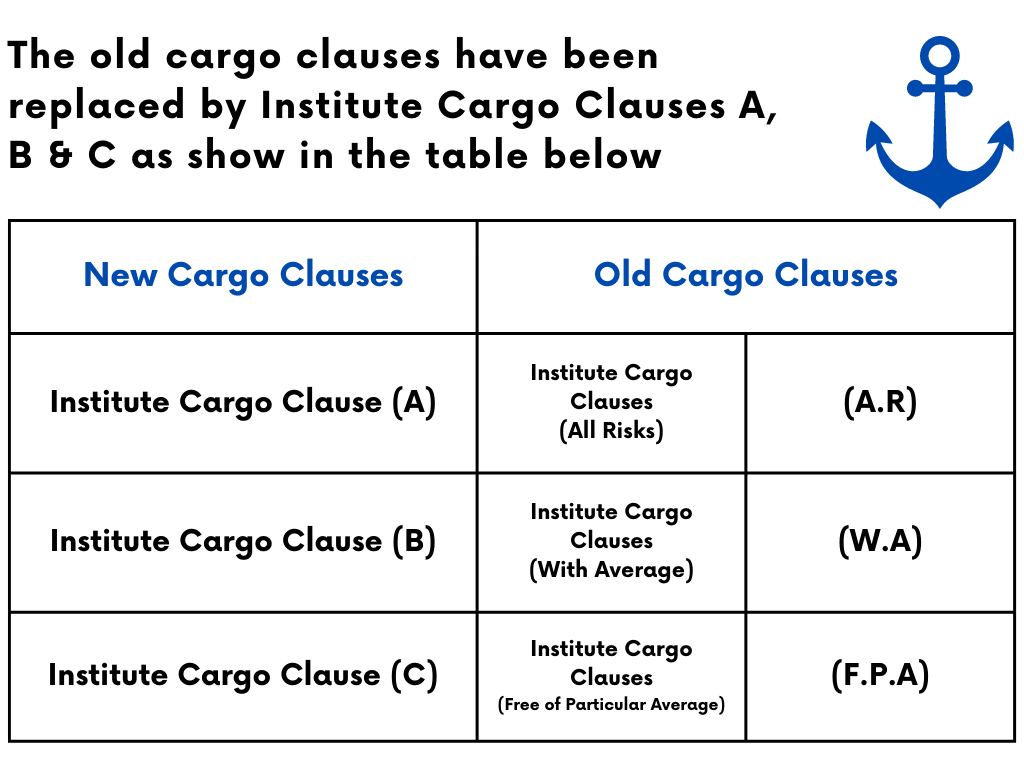

Cargo Clauses: Cargo insurance provides coverage for goods in transit. There are three main types of cargo coverage:

a) Old Cargo Clauses: These are the earlier versions of cargo insurance clauses.

b) Institute Cargo Clauses (A), (B), and (C): These clauses offer different levels of coverage for cargo, with Clause A providing the most comprehensive coverage and Clause C offering more limited coverage.

c) War and Strike Clauses: These clauses specifically address risks related to war and strikes that may impact cargo shipments.

Overall, the Institute Clauses establish the terms and conditions of insurance policies, ensuring that both the insurer and the insured have a clear understanding of the coverage and exclusions provided.

These new clauses have distinct exclusions that are important to note:

- Free of Capture and Seizure Clause (F.C.&S. Clause): This clause excludes the risks associated with war. It ensures that the insurance coverage does not extend to losses or damages caused by war-related events such as capture or seizure.

- Free of Strikes, Riots, and Civil Commotions Clause (F.S.R.&C.C. Clause): This clause excludes the risks associated with strikes, riots, and civil commotions. It means that losses or damages resulting from these events are not covered by the insurance policy.

- Exclusion of Delay and Inherent Vice: These new clauses also exclude the risks of delay in delivery and losses caused by inherent vice. This means that if there is a delay in the delivery of the insured goods or if the goods deteriorate due to their inherent characteristics, such losses or damages will not be covered by the insurance policy.

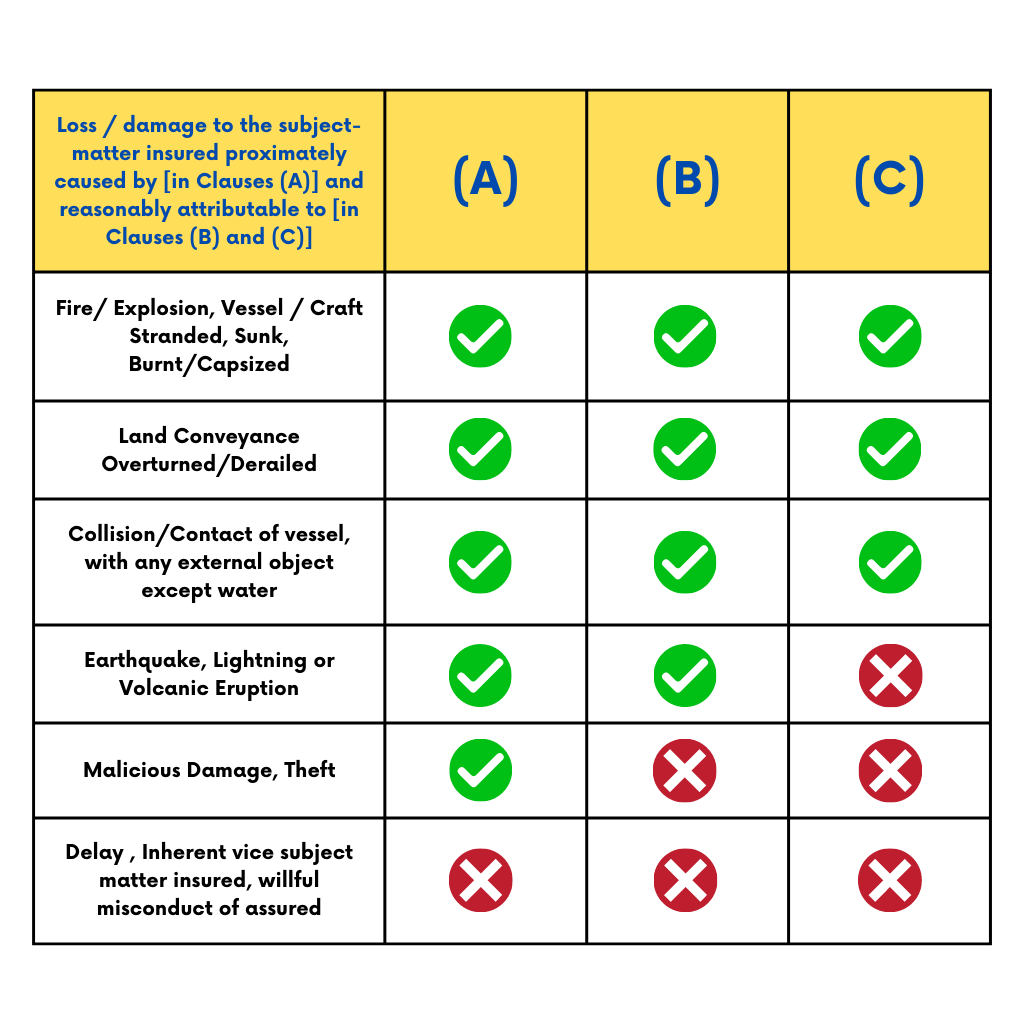

The table below shows a comparison of the items covered by Institute Clauses A, B and C.

In addition to the Institute Cargo Clauses A, B, and C, there are other Institute Clauses that are relevant to cargo insurance. To obtain further information about these clauses, please refer to the document provided in this link: [Click here (PDF, 125kb)].

War and Strike Clauses: These clauses serve as supplementary provisions to the Institute Cargo Clauses A, B, and C, and their coverage is outlined as follows.

Scope of Institute War Clauses: The Institute War Clauses provide coverage for:

- Risks that are excluded by the FC&S Clause in the Institute Cargo Clauses.

- Losses or damages to the insured interest caused by hostilities, warlike operations, civil war, revolution, rebellion, insurrection, or civil strife, including damages resulting from mines, torpedoes, bombs, or other war-related devices.

- General Average (GA) and salvage charges incurred for the purpose of avoiding or mitigating losses covered by these clauses.

However, it is important to note that these clauses specifically exclude losses, damages, or expenses arising from the hostile use of any weapon involving atomic/nuclear fission or fusion, or any other radioactive reactions.

Scope of Institute Strike Clauses:

- They cover losses or damages to the insured property caused by strikers, locked-out workers, individuals involved in labor disturbances, riots, civil commotions, or acts of malice.

- They do not cover losses or damages directly caused by delays, inherent vice, or the nature of the insured property. Additionally, losses or damages caused by hostilities, warlike operations, civil war, revolution, rebellion, insurrection, or civil strife arising thereof are not covered by these clauses.

It should be noted that in the United States and certain other regions, the American Institute Clauses, also known as the American Clauses, are utilized instead of the London Clauses. The American Clauses may differ from the London Clauses in their provisions and terms.

Marine cargo policies typically include several exclusions, which are important to understand. Here are some of the common exclusions:

- Loss caused by willful misconduct of the insured.

- Ordinary leakage, loss in weight or volume, or normal wear and tear. These are considered typical trade losses that are expected and not accidental in nature.

- Loss caused by the inherent characteristics or nature of the subject matter. For example, perishable goods like fruits and vegetables may deteriorate without any accidental cause, which is known as "inherent vice."

- Loss caused by delays, even if the delay is caused by a covered risk.

- Loss or damage due to inadequate packing.

- Loss arising from the insolvency or financial default of vessel owners, operators, etc.

- War and related perils. These risks can be covered by paying an additional premium.

- Strikes, riots, lockouts, civil commotions, and terrorism (SRCC). Coverage for these risks can also be obtained by paying an extra premium.

If you are an individual trying to export goods, one practical way to insure your cargo is to consult a freight forwarder and have them arrange insurance on your behalf. Many freight forwarders have their own master policy through which they can issue insurance.

The freight forwarder will determine the premium based on the value of your commercial invoice to the buyer, adding a 10% margin. For instance, if your invoice value is $500,000, the freight forwarder will calculate the premium based on 110% of this value, which is $550,000. The additional 10% accounts for the potential loss of the buyer's potential profit.

Upon issuing the insurance certificate, it is crucial that you receive it as proof that you have insured the cargo under CIF or CIP terms for the correct value and coverage. The buyer may require this proof. Remember, you can insure the cargo under any delivery term, such as EXW, FCA, CPT, DAT, DAP, DDP, FAS, FOB, CFR, and bear the expenses yourself. Marine insurance is not limited to just CIF/CIP terms.

Here are a few case studies related to Institute Time Clauses in maritime insurance:

Case Study 1: Machinery Breakdown

A cargo ship was transporting machinery equipment when one of the engines experienced a sudden breakdown. The repair process took several weeks, causing a significant delay in the delivery of the cargo. As per the Institute Time Clauses, the insurer covered the loss of time and expenses incurred during the repair period, ensuring compensation for the insured's financial losses due to the machinery breakdown and resulting delay.

Case Study 2: Piracy Attack

A vessel carrying a valuable cargo was hijacked by pirates while sailing through a high-risk area. The crew was held captive for several days until a ransom was paid for their release. Under the Institute Time Clauses, the insurer covered the loss of time and expenses incurred during the incident, including the costs associated with the crew's captivity and the subsequent vessel recovery process.

Case Study 3: Collision and Salvage

Two ships collided in a congested port area, resulting in damage to both vessels and the cargo they were carrying. The damaged vessels had to be towed to a safe location and underwent extensive salvage operations. The Institute Time Clauses provided coverage for the costs associated with salvage, temporary repairs, and the delay in delivering the cargo due to the collision.

Case Study 4: Fire on Board

A fire broke out in the cargo hold of a container ship, causing significant damage to the cargo and requiring immediate action to extinguish the fire. The Institute Time Clauses covered the costs of firefighting, salvage operations, temporary repairs, and the resulting delay in cargo delivery caused by the fire incident.

These case studies demonstrate how the Institute Time Clauses in maritime insurance policies can provide coverage for various scenarios, such as machinery breakdowns, piracy attacks, collisions, and fires. It is important for insured parties to carefully review their specific policy terms and conditions to understand the extent of coverage and exclusions applicable to their particular situation.

The Institute Time Clause is a crucial aspect of marine insurance policies that defines the duration and scope of coverage for vessels and cargo. Understanding the ITC provisions is essential for shipowners and cargo owners to ensure adequate protection against maritime risks. By exploring case studies, we have seen how the ITC can be applied in real-world scenarios to determine coverage and provide compensation for losses and damages. To ensure proper coverage, it is essential to consult with insurance professionals and carefully review the Institute Time Clause within marine insurance policies.

Happy Sailing & Happy Learning!

Think Family, Safety First!